Mastering Market Research: Your Ultimate Guide to Success

Market research is your compass in the business world, guiding you to your destination – success. Whether you’re launching a product, assessing customer satisfaction, or understanding the ever-shifting market landscape, market research is the key. In this comprehensive guide, we’ll take you from the statistics that underline this industry to the nitty-gritty of how to do it right. The blog will cover the following:

1. Overall Statistics of Market Research as a Market Size

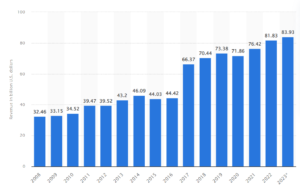

The market research industry plays a pivotal role in helping businesses gather essential information about their customers and target markets. It aids in streamlining services and enables companies to make well-informed business and political decisions. In 2022, the global revenue of the market research industry exceeded an impressive 81 billion U.S. dollars, signifying steady growth since 2008.

North America led the charge, generating over half of the total market research revenue in 2021, with Europe contributing a significant quarter of the global market share.

Figure: Overall Statistics of Market Research Revenue from 2008 – 2023 (Source: Statista)

2. Definition of Market Research | What is Market Research?

Market research is the process of gathering, analysing, and interpreting data about a market, its consumers, and the competitive landscape. It is a critical tool for businesses to make informed decisions. For instance, consider a scenario where a tech startup is about to launch a new fitness-tracking app.

Why consider Market Research?

Market research can help determine if there’s demand for such an app, what features customers are looking for, and how it should be priced.

When to consider Market Research?

Market research is essential when:

- Launching a new product or service

- Understanding Total Available Market (TAM) size, Serviceable Available Market (SAM), and Share of Market (SOM)

- Assessing customer satisfaction

- Testing a product idea or Minimum Viable Product (MVP)

- Evaluating the potential success of a new feature or improvement

- Investigating whether people would buy the product

3. Types of Market Research

Quantitative Research:

Focuses on numerical data and answers “how many” or “how much.” It involves surveys, experiments, and data analysis.

Figure: Quantitative Research | Robas Research

Local Example:

A local bakery wants to understand the most popular types of pastries among its customers. They conduct a survey in their neighbourhood, collecting numerical data on pastry preferences.

Global Example:

A multinational tech company wants to assess the market demand for a new smartphone. They conducted a survey across several countries, gathering numerical data on consumer preferences and willingness to pay.

Qualitative Research:

Qualitative Research: Aims to gain an in-depth understanding of customer behavior and opinions. It includes methods like interviews, focus groups, and observations.

Figure: Qualitative Interviews | In-person Interviews | Robas Research

Local Example:

A small clothing boutique conducts in-store interviews with customers to understand their feelings and attitudes towards the store’s fashion collection.

Figure: In-store interviews for a small shop | Ro-bas.com

Global Example:

A global fast-food chain organizes focus groups in various countries to gather insights on cultural differences in food preferences and eating habits.

4. Market Research Methods, Pros and Cons of Each Method

Interviews:

Engage customers in a one-on-one conversation to delve deep into their experiences.

Benefits: Personalized insights.

Challenges: Time-consuming, potential bias.

Example: A software company interviews customers to uncover their pain points and preferences.

Observation-based Research:

Watch customers’ real-world behavior to understand their needs.

Benefits: Real-world data.

Challenges: Limited to observable actions, potential bias.

Example: A supermarket studies customer flow to optimize product placement.

Secondary Market Research:

Analyze existing data sources to extract valuable insights.

Benefits: Cost-effective, time-efficient.

Challenges: Data might not be tailored to specific needs.

Example: A healthcare startup uses industry reports to grasp market trends.

Surveys:

Cast a wide net by administering questionnaires to a large group of respondents.

Benefits: Large-scale data collection.

Challenges: Response bias, limited depth.

Example: An e-commerce platform surveys customers to assess satisfaction.

Competitive Analysis:

Study your competitors to grasp market dynamics and inform your strategy.

Benefits: Strategic insights, gap identification.

Challenges: Limited access to competitor data, potential bias.

Example: An automobile manufacturer analyzes competitors for pricing strategies.

Focus Groups:

Assemble diverse groups to discuss and provide feedback.

Benefits: Rich insights and group dynamics.

Challenges: Small sample size, potential for groupthink.

Example: A cosmetic brand conducts focus groups to evaluate new product concepts.

As per Statista, the most common type of traditional quantitative research methods globally were online surveys, used by over 90 percent of market research professionals in 2022. The same survey revealed that phone and face-to-face interviews accounted for 80 percent and 39 percent of quantitative research methods respectively. In terms of qualitative research methods, online in-depth interviews were the most common method, making up more than two-thirds of this line of research conducted in 2022.

5. How to do Market Research (Step by Step)

Step 1: Define Your Objectives

Imagine you’re a budding tech startup with an innovative language-learning app. Your goal is to understand if there’s demand for your app in the market. To begin, you must define clear objectives: Do you want to find out how many potential users exist? What are their preferences and pain points? Define these objectives to set the direction for your research.

Step 2: Identify Your Target Audience

You’ve identified your primary audience as tech-savvy adults aged 18-35 interested in learning a new language. Your research must focus on this group to gather relevant insights. Identifying the right audience is crucial to ensure your research efforts are focused and actionable.

Step 3: Choose Your Research Type (Quantitative or Qualitative)

In this case, you opt for quantitative research because you want to gather numerical data. You need to gauge the potential user base and understand the extent of their interest. Quantitative research will provide you with the numbers you need to make informed decisions.

Step 4: Select Research Methods

You decide to conduct an online survey as it’s a cost-effective way to reach a large audience. Surveys allow you to gather responses from a broad group of potential users, providing quantitative data.

Step 5: Create Research Instruments (Questionnaires, etc.)

You create a well-crafted questionnaire that asks users about their language-learning habits, previous app usage, and preferences. It’s essential to design your research instruments in a way that captures the information needed to meet your objectives.

Figure: Create Research Instruments (Questionnaires, etc.), Shows CATI

Step 6: Collect Data

To collect data, you distribute the survey through various channels. You share it on social media platforms, send it to your email subscriber list, and even partner with language-learning forums to increase the reach. The more responses you collect, the more robust your insights will be.

Step 7: Analyze Data

Once you’ve gathered a significant number of responses, it’s time to analyze the data. You use data analysis tools to examine the survey results. In this step, you’ll discover the percentage of respondents interested in your language-learning app and gain insights into their preferences and needs.

Step 8: Draw Insights and Make Informed Decisions

Based on your data analysis, you find that 70% of respondents express interest in your app. This insight indicates a potential market opportunity. You also identify common preferences among potential users, such as gamified learning features or interactive lessons. Armed with these insights, you can make informed decisions about the app’s development, marketing strategies, and pricing.

7. Why Robas Research should be considered as one of the best market research companies?

Robas Research has earned its reputation as a leading market research company for several reasons:

- With over 11 years in the industry, they have a proven track record of success.

- Their global and local experience ensures a comprehensive understanding of markets worldwide with various data collection

- They are adept at all types of market research studies, from customer satisfaction surveys to competitive analysis.

- Robas Research excels in employing various market research methods, adapting to local and global scenarios. For instance, they have conducted in-depth interviews with consumers in diverse regions, executed observational studies, and provided comprehensive competitive analysis reports.

Summing Up

In conclusion, market research is your compass in the ever-changing business landscape, guiding you toward informed decisions and a prosperous future. By understanding the industry’s dynamics, choosing the right methods, and following a step-by-step approach, you can uncover valuable insights that drive your business forward.

With market research as your trusted ally, you’ll have the knowledge and tools to not just survive but thrive in the competitive world of commerce. So, set your sights high, embrace the power of data, and let market research be your guiding star on the path to success. To know more, contact Robas Research.

8. Frequently Asked Questions

Where does marketing research start from?

Marketing research started with generating a product idea. The most innovative and forward-thinking inventors and innovators came up with these ideas based on societal challenges. Once the marketability of a product was determined, the next stage was to design it.

Can you do market research in-house?

Yes, you can conduct market research in-house by assembling a dedicated team or hiring experts.

Define Market Research

Market research is the process of collecting and analyzing data to understand market dynamics, consumer behavior, and competition.

Why Market Research Revenues are increasing day by day?

The increasing complexity of markets, globalization, and the need for data-driven decisions contribute to the growth of market research.

What is the skill sets necessary to do market research or to be a market researcher?

Skills include data analysis, communication, research design, and understanding consumer behavior.

What are the top 5 types of market research?

Quantitative, Qualitative, Secondary Research, Observational Research, and Survey Research.

Who are the top market research companies in the world?

Major players include Nielsen Holdings, Kantar, IQVIA, Ipsos, and GfK Group. Robas Research comes across as a top niche market research agency.

What are the 8 steps of market research?

Objectives, Target Audience, Research Type, Methods, Research Instruments, Data Collection, Data Analysis, and Decision-Making.

What is the budget of a market research study generally takes?

The budget varies widely depending on the scope and methods used. It can range from a few hundred dollars for a small survey to millions for extensive global studies.

What should be the budget of primary research?

The budget for primary research is usually higher as it involves gathering original data. It depends on factors like sample size and research complexity.

What is the budget for secondary research?

Secondary research is often more cost-effective, as it involves analyzing existing data. Budgets can vary from a few thousand to tens of thousands of dollars.

Can primary research study be done in-house?

Yes, primary research can be done in-house if you have the necessary skills and resources.

Can secondary research study be done in-house?

Absolutely, you can conduct secondary research in-house by accessing existing data sources and conducting the analysis internally.